Prudent funding & liquidity management starts with clarity

In today’s complex markets, even the most sophisticated institutions face structural barriers to achieving a clear, consolidated view of funding and liquidity.

Persistent obstacles include:

Regulatory Pressure

Regulatory frameworks continue to evolve — demanding more granular reporting, demonstrable liquidity coverage, and robust stress-testing across all entities and booking models.

Balance Sheet Constraints

Leverage ratios, capital buffers, and balance sheet optimization mandates limit flexibility in deploying funding and inventory — forcing desks to operate within increasingly narrow utilization envelopes.

Liquidity Requirements

Supervisors now expect proactive liquidity risk management, including comprehensive visibility, counterparty concentration monitoring, and contingency funding planning — all requiring consistent, high-quality data across products.

No Realtime Data

Intraday positions and collateral movements are often captured in isolation or omitted from enterprise datasets — masking true liquidity usage and obscuring drivers of intraday funding pressure.

Fragmented Data

Funding, collateral, and position data are dispersed across trading books, treasury systems, risk engines, and legal entities, each with distinct conventions, timing, and granularity.

Siloed Data Sources

Disconnected systems lack the traceability to link assets, liabilities, and clients, leaving firms unable to attribute funding costs, liquidity consumption, or balance sheet impact with confidence.

Without a unified, analytics-driven framework, true agility and regulatory confidence remain out of reach.

A unified platform for funding & liquidity intelligence

Pleeco Fluent is an analytics-driven funding and liquidity management platform that connects the dots across your balance sheet.

Transform disparate funding, inventory, and client datasets into a cohesive, connected model reflecting the true structure of assets, liabilities, and counterparties across secured, unsecured, and internal sources. Gain full transparency into the sources and uses of cash and securities — creating a reliable foundation for forecasting, stress testing, pricing, and strategic decision-making.

Your funding & liquidity strategy can make or break your ability to grow

Manage funding and liquidity holistically — from detailed traceability to forward-looking analytics and optimization.

Explore Fluent solutions:

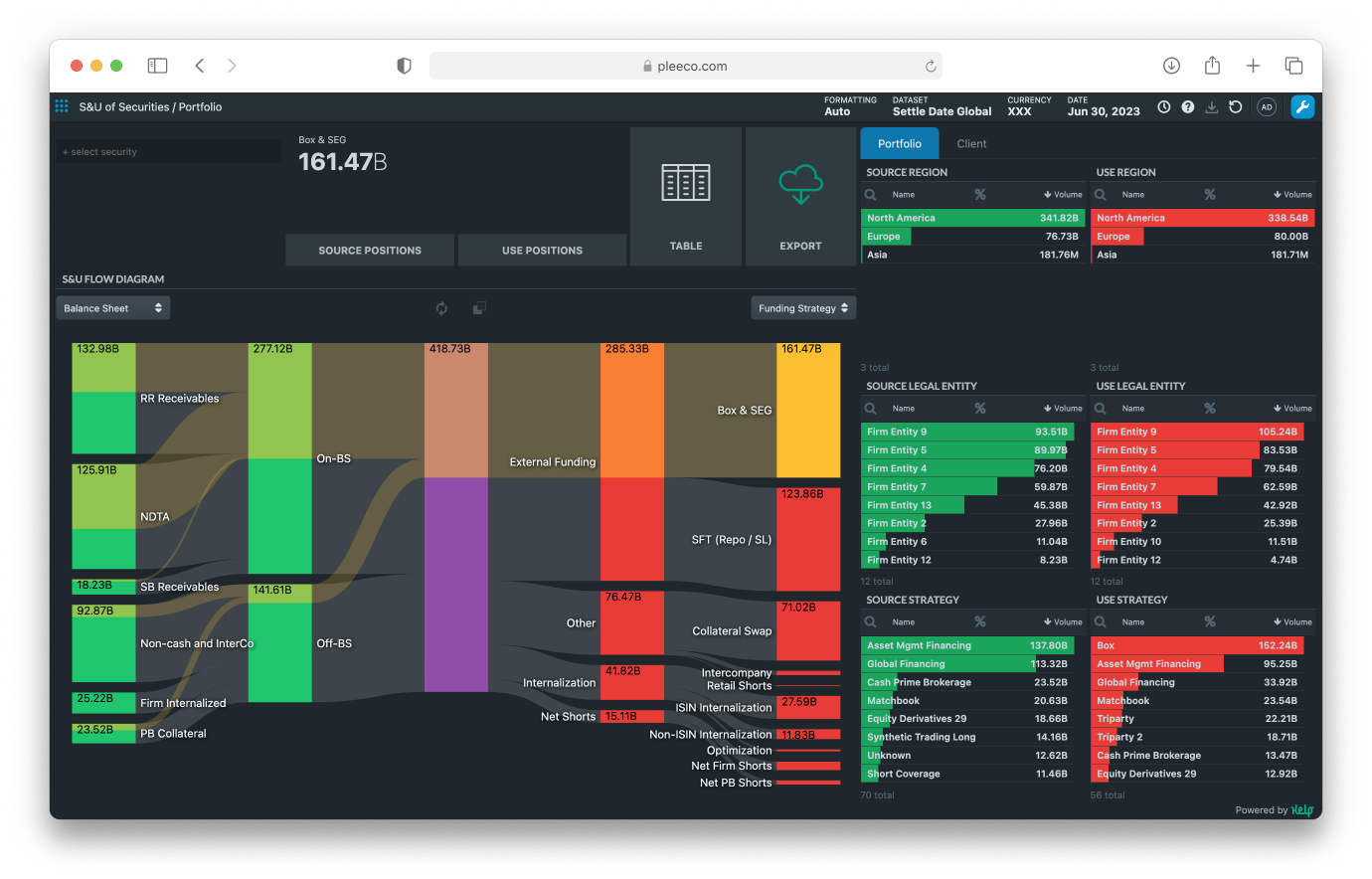

Funding Traceability

End-to-end visibility across secured, unsecured, and Intraday funding.

Liquidity Risk Management

Identify risk drivers, define limits, and monitor early warning indicators.

Stress Testing

Model scenarios across secured funding, derivatives, PB, and intraday liquidity.

Cash Flow Forecasting

Anticipate daily funding needs and incremental usage by business line.

Funds Transfer Pricing

Allocate funding costs and liquidity buffers in line with SR16-3.

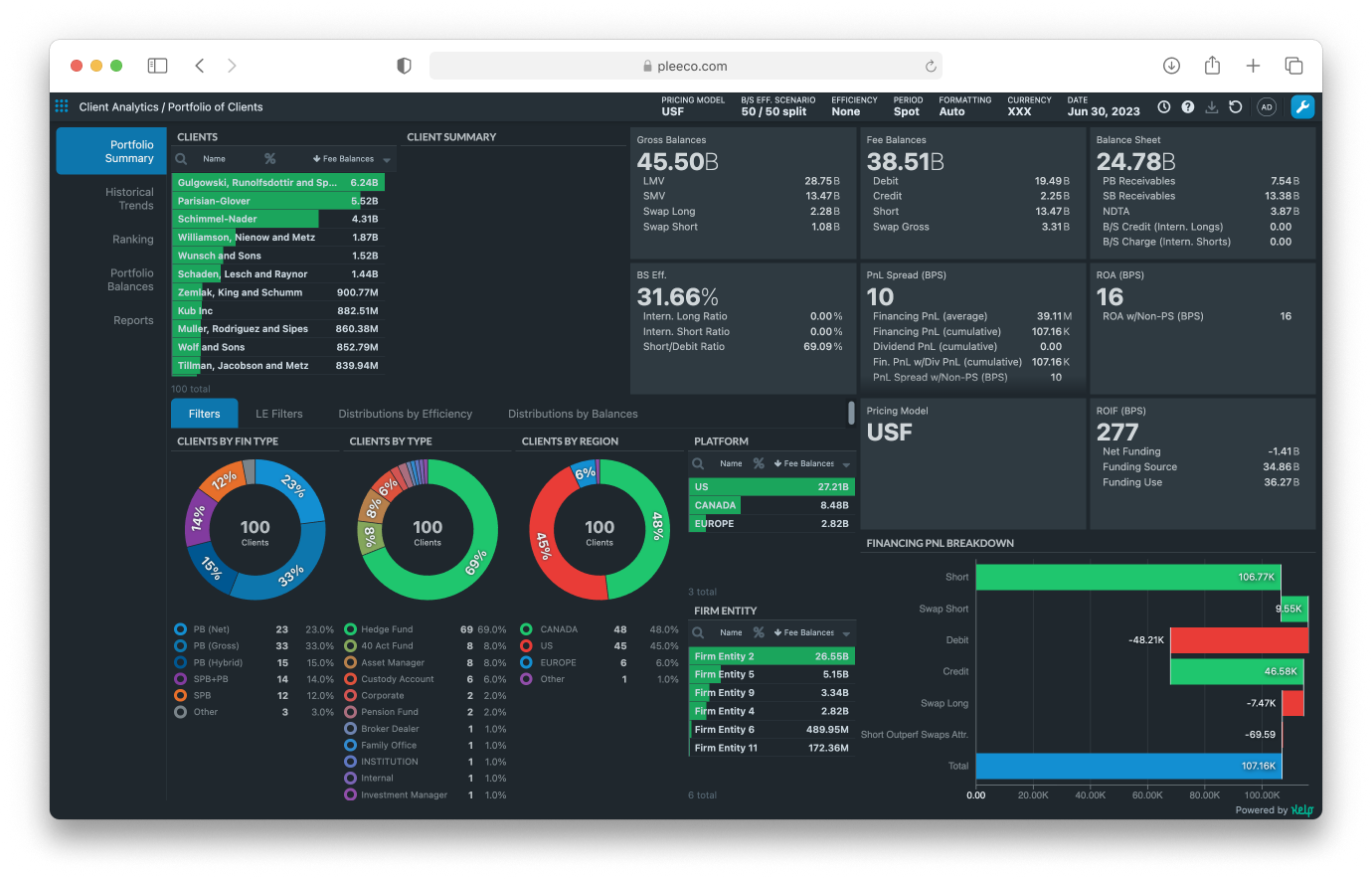

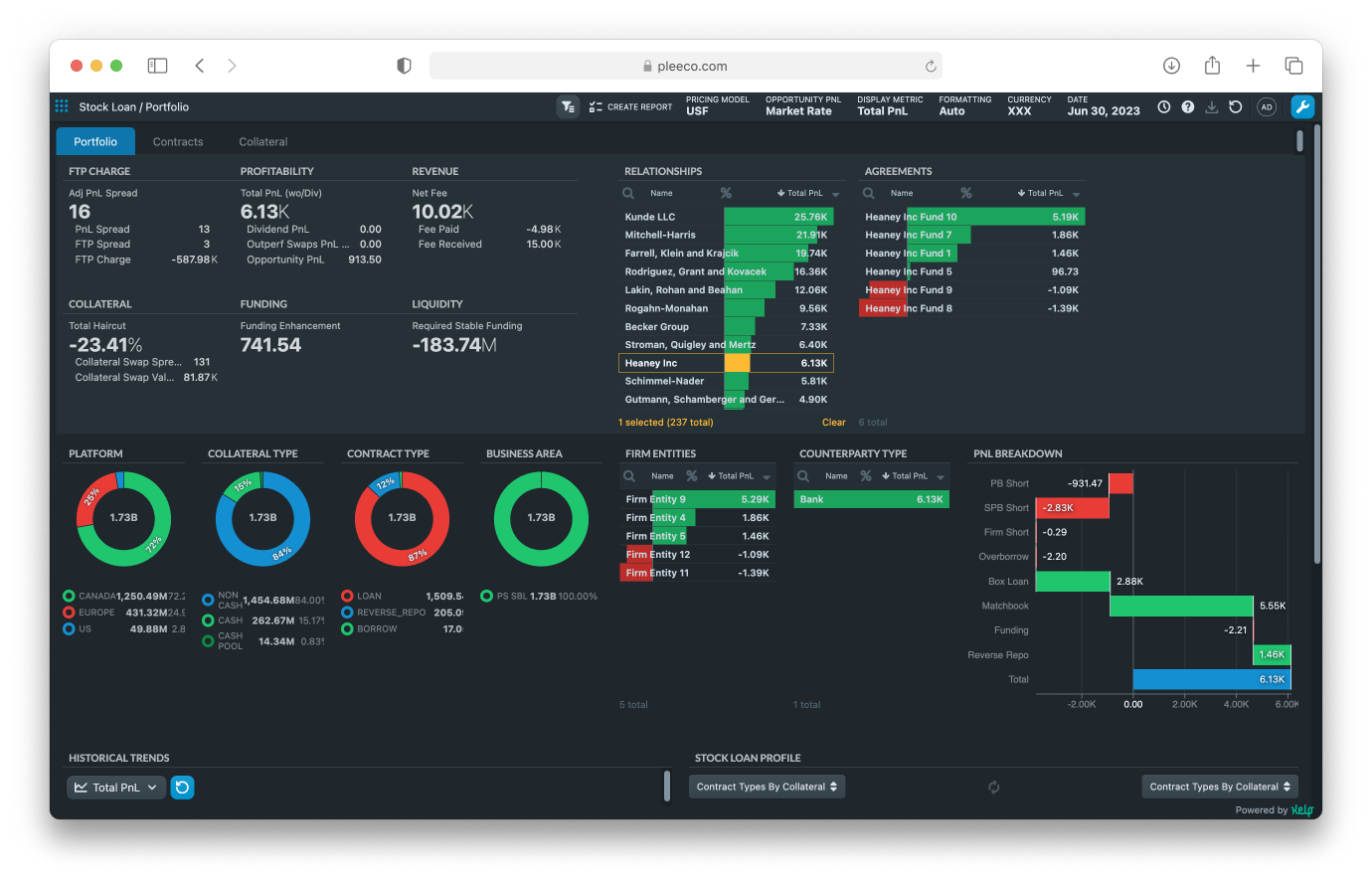

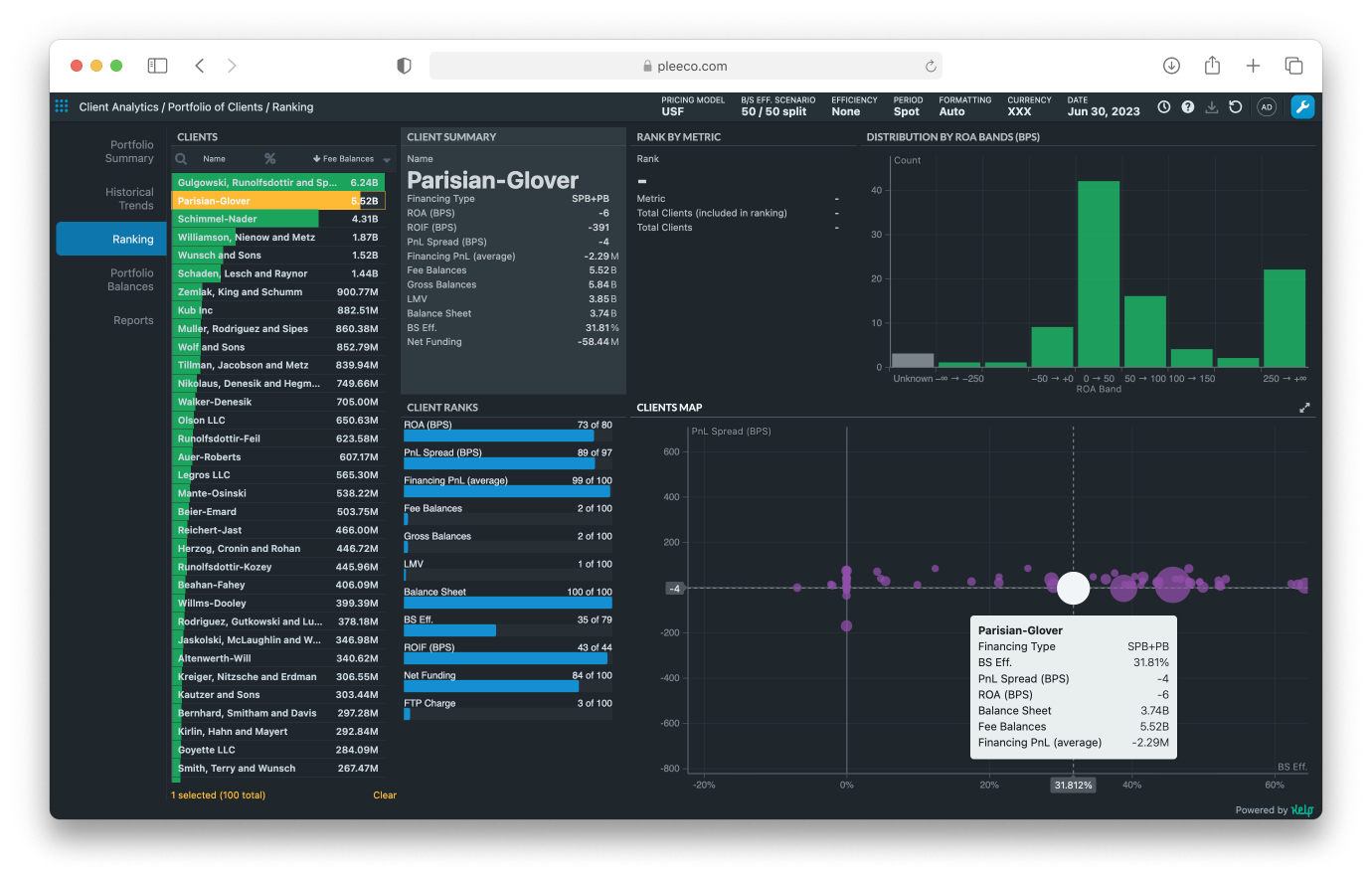

Client & Desk Analytics

Measure ROA, balance sheet footprint, and liquidity contribution.

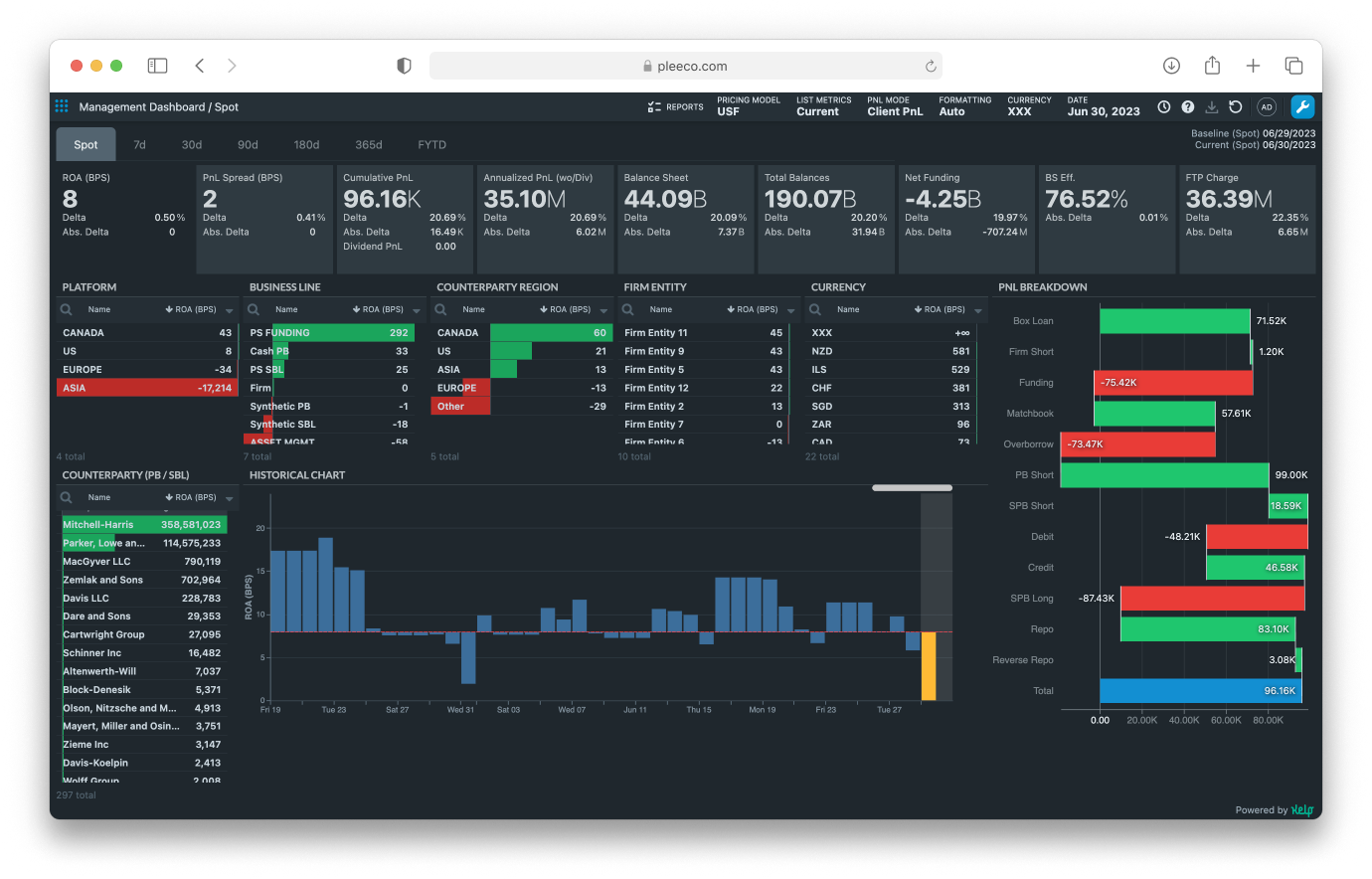

Realtime insights into your most critical questions

Bring consistency, speed, and confidence to your decision-making. Get clear answers to the questions that matter most.

How do I fund my business most efficiently?

Who is driving my unsecured funding usage?

Am I optimizing my collateral usage?

Which clients consume the most balance sheet and liquidity?

How much liquidity can I raise from unencumbered assets?

What is my liquidity position under stress?

Am I pricing clients according to their funding and liquidity impact?

How do I align FTP charges with actual resource consumption?

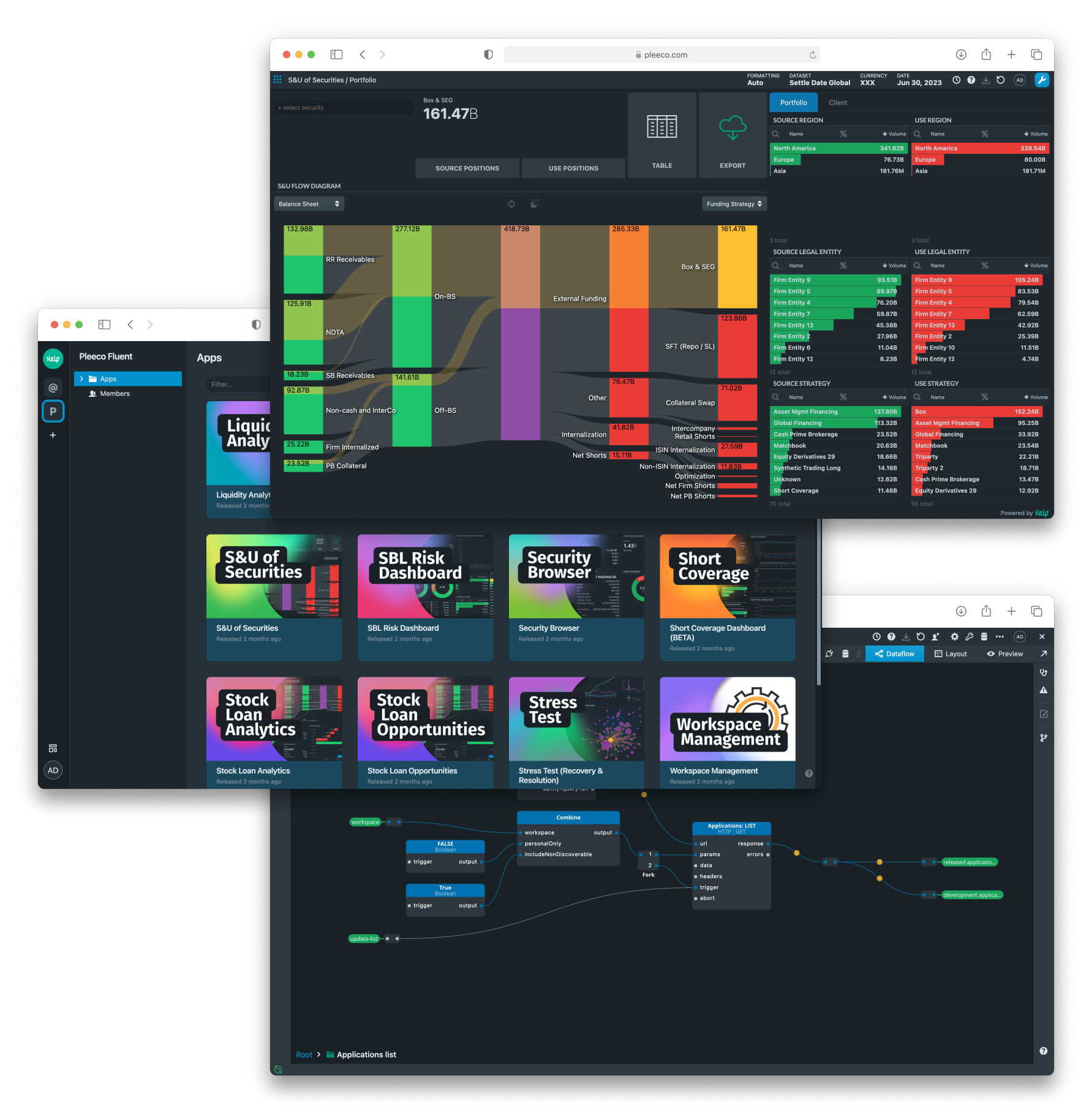

Pre-built analytics apps — ready to deploy and customize

A unified suite of pre-built analytical modules — designed to support Securities Finance, Treasury, Risk, and Finance teams across the funding lifecycle.

Choose from these tools and get started today:

One source of truth for your funding ecosystem

Align stakeholders across functions with a single data asset.

Securities Finance

Core funding & liquidity analytics

Treasury

Forecasting, planning, stress testing

Risk

Scenario modeling, early warning indicators

Finance

Funds Transfer Pricing, P&L attribution

Sales & Client Services

Client profitability and pricing insights

Compliance

Regulatory reporting support

Fluent adapts to your business

— not the other way around

Pleeco delivers an integrated stack of scalable data platform, low-code development tools, and pre-built analytics apps to address your particular development needs.

Applications – Ready-to-use analytics apps for high-value use cases (Liquidity, Stress Testing, Client Analytics, Basket Analysis) Development Tools – Collaborative low-code frameworks for custom analytics and integrations Platform – Unified suite of data, orchestration, security, and visualization services — enabling production-ready deployments.

Tangible results in weeks, not years

Our proven onboarding framework ensures tangible outcomes within the first quarter.

1. Discovery Workshop | 2 hours | |||

2. Technology Assessment | 2–3 days | |||

3. Functional Trial | 8–12 weeks | |||

4. Production Deployment | 3–6 months |